what is suta tax rate

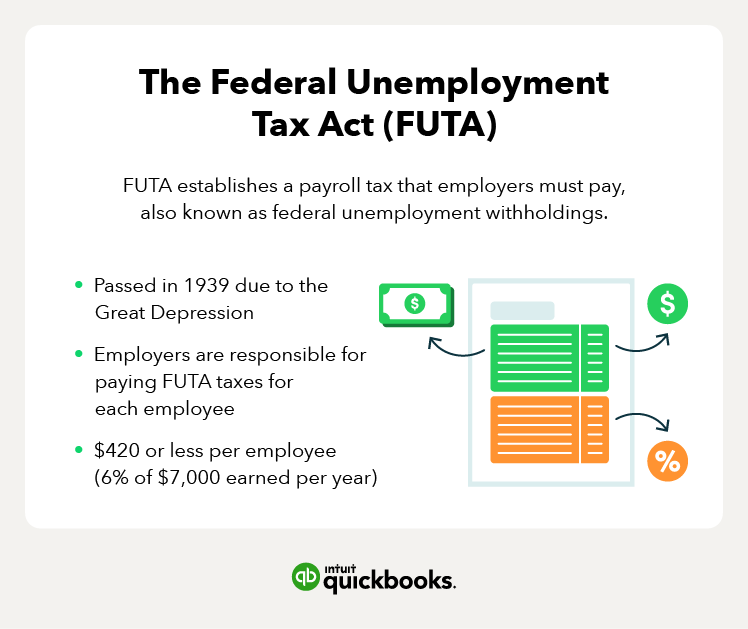

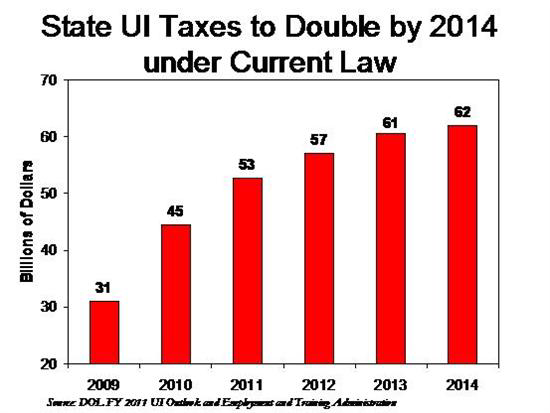

Special Assessment Federal Loan Interest Assessment for. The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund.

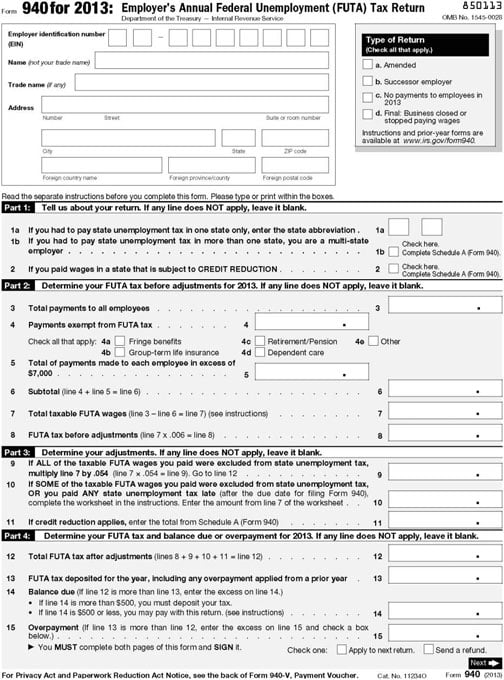

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

In Mississippi the tax rate for a start-up business is 100 the first year of liability 110 the second year of liability and 120 the third and.

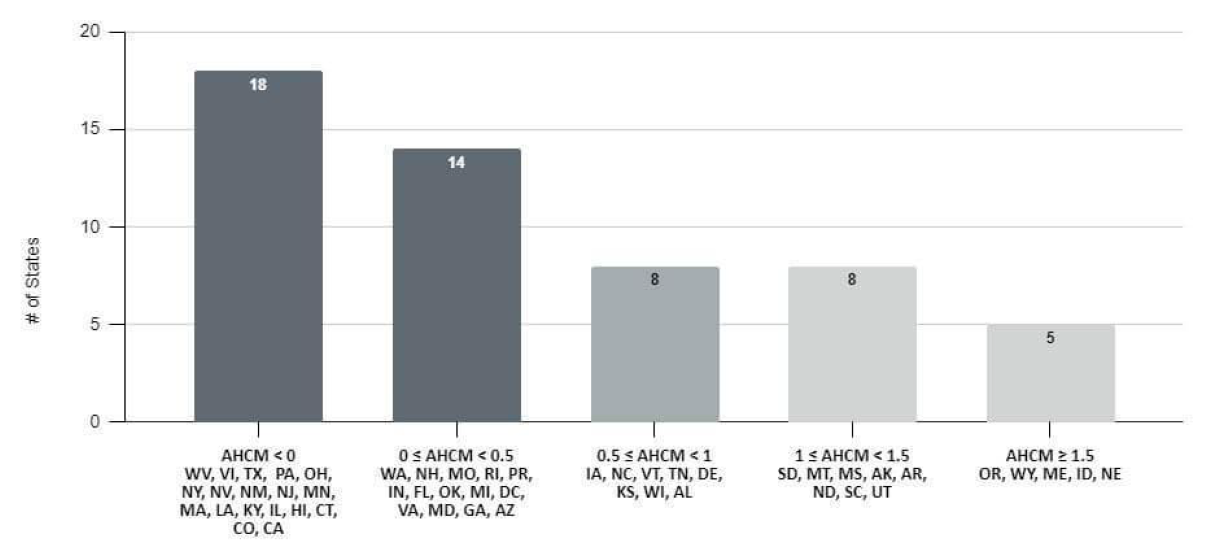

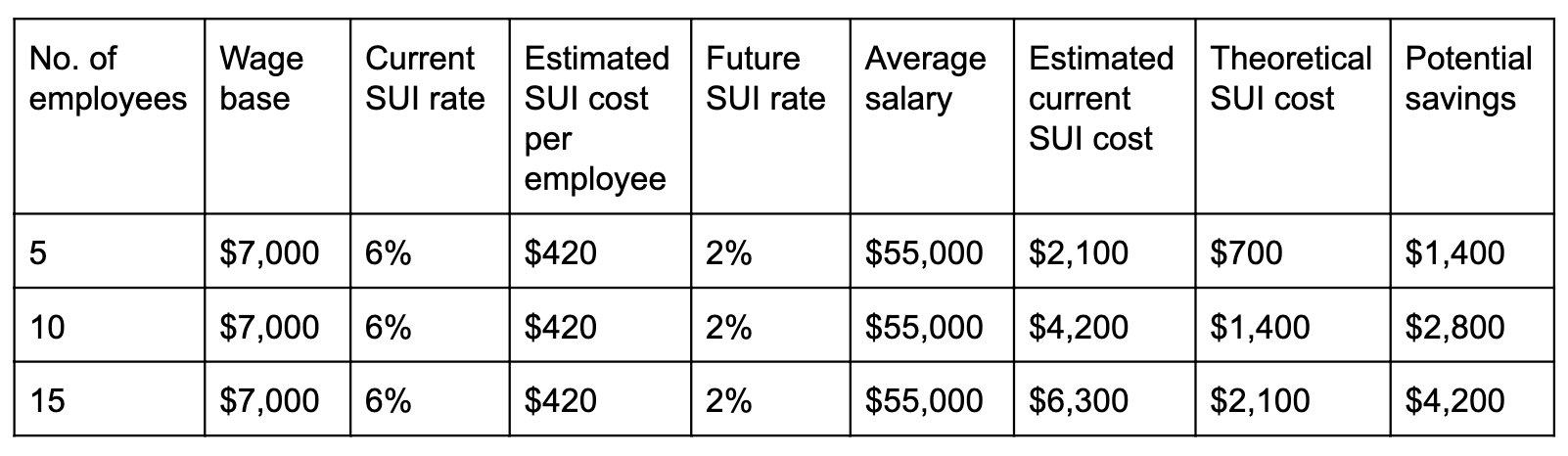

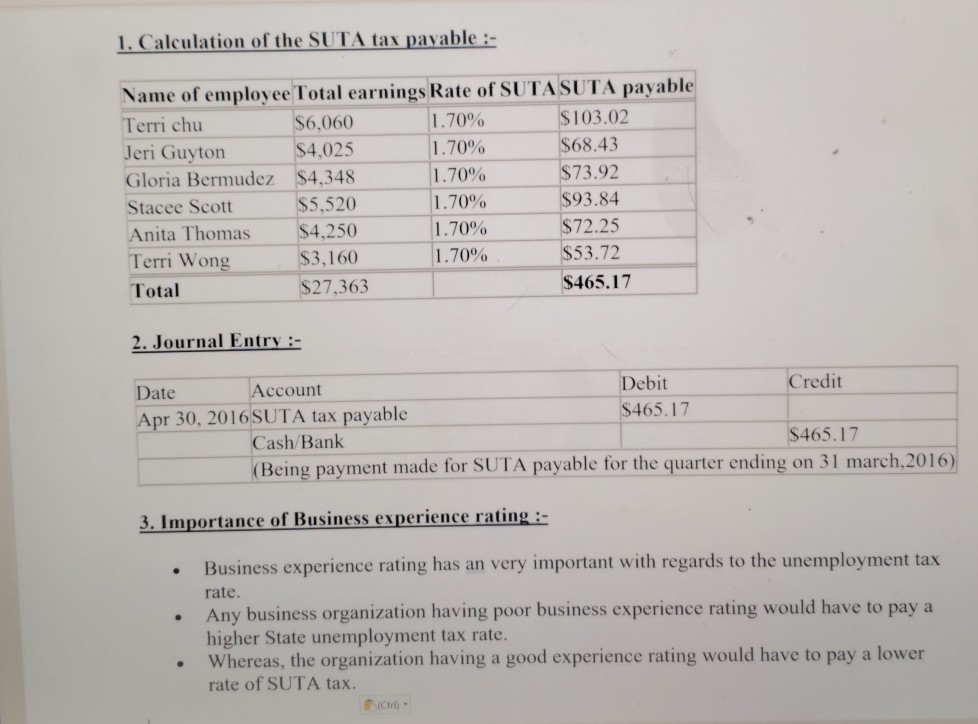

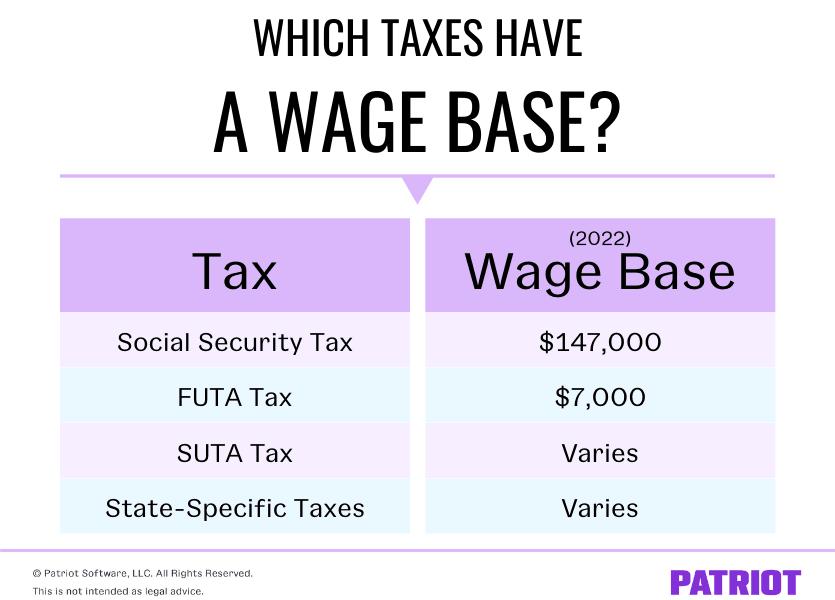

. The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years. General employers are liable if they have had a quarterly payroll of 1500. State taxes vary including the State Unemployment Tax Act SUTA contribution rates.

The state unemployment tax act also called SUTA imposes a tax on the wages that employers pay to their employees. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax email or postal. 0010 10 or 700 per.

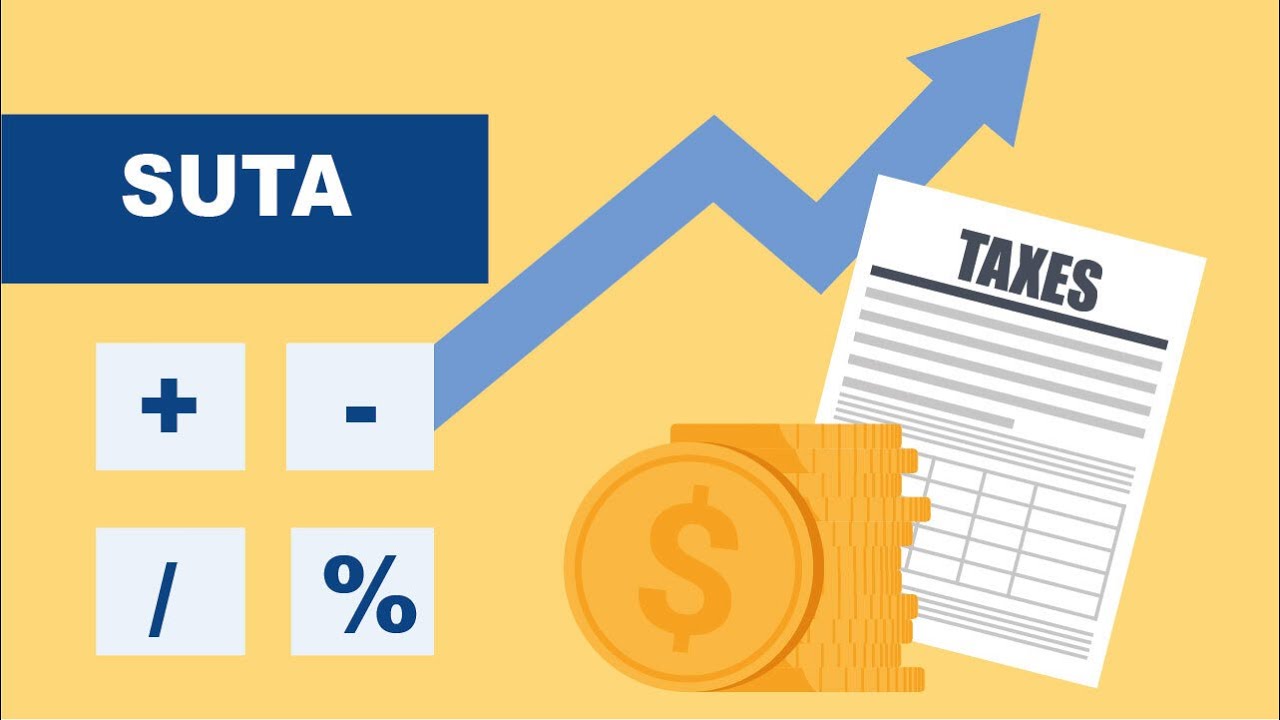

You should be aware of current rates and understand how the tax is calculated. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Taxable base tax rate.

Current Tax Rate Filing Due Dates. The 2022 wage base is 7700. The detailed information for Oregon Suta Tax Rate is provided.

State Unemployment Tax Act SUTA avoidance or dumping is a form of tax avoidance or UI tax rate manipulation through which employers dump higher UI taxes by attempting to obtain a. Louisiana Unemployment Insurance Tax Rates. The states SUTA wage base is 7000 per.

Tax rate for experienced employers. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated. Nevada Office of the Labor Commissioner.

Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. Base Tax Rate for 2022 from 050 to 010. This tax is used by the state to fund the unemployment.

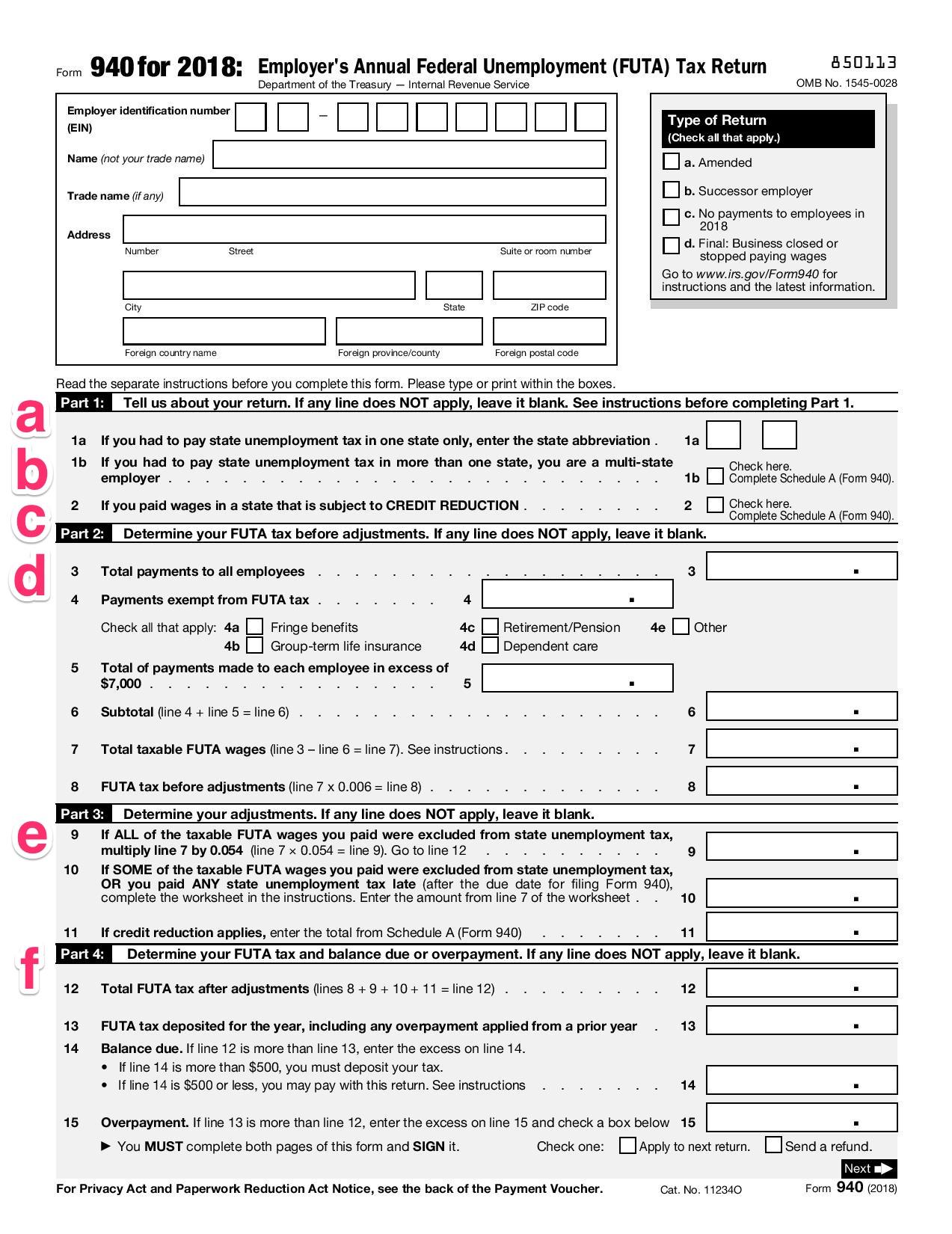

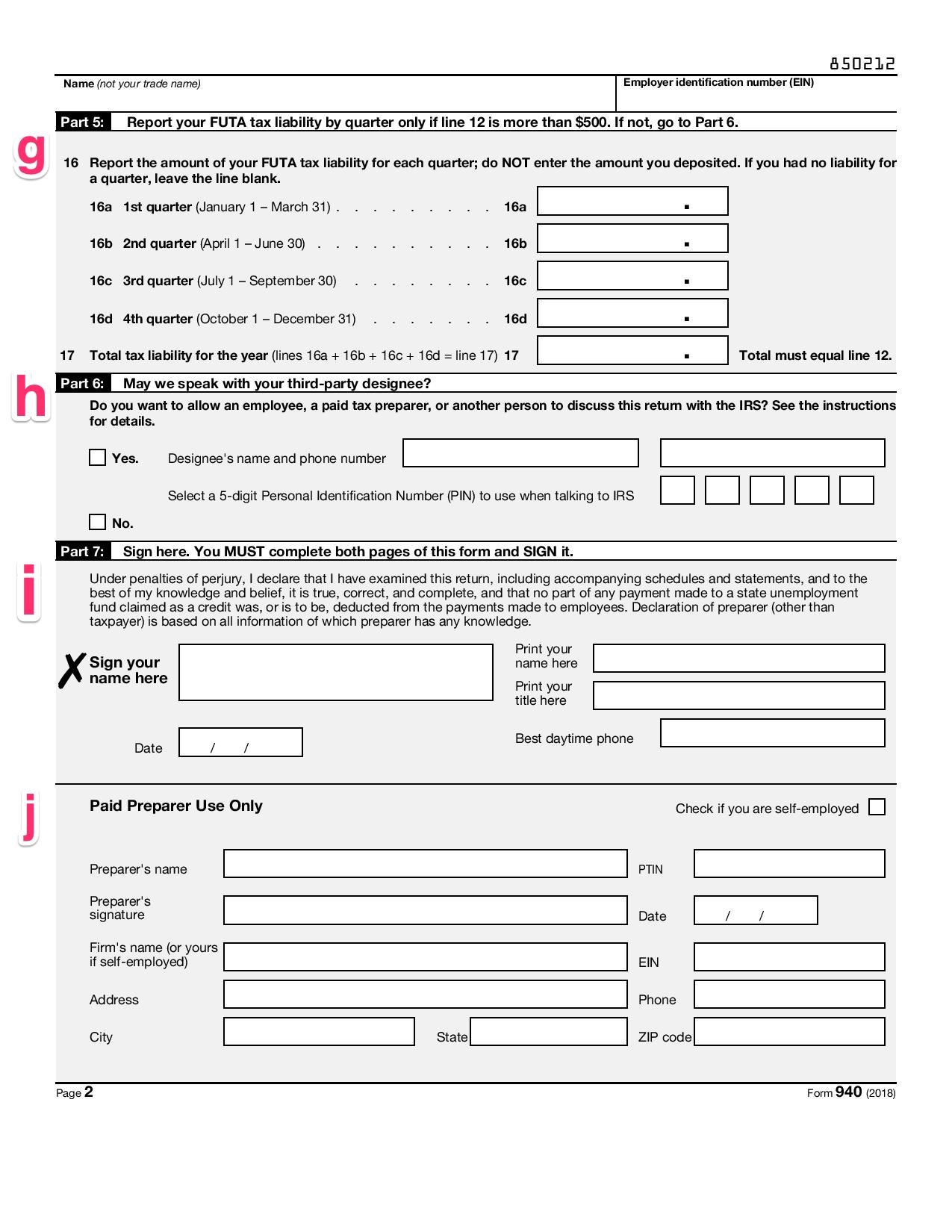

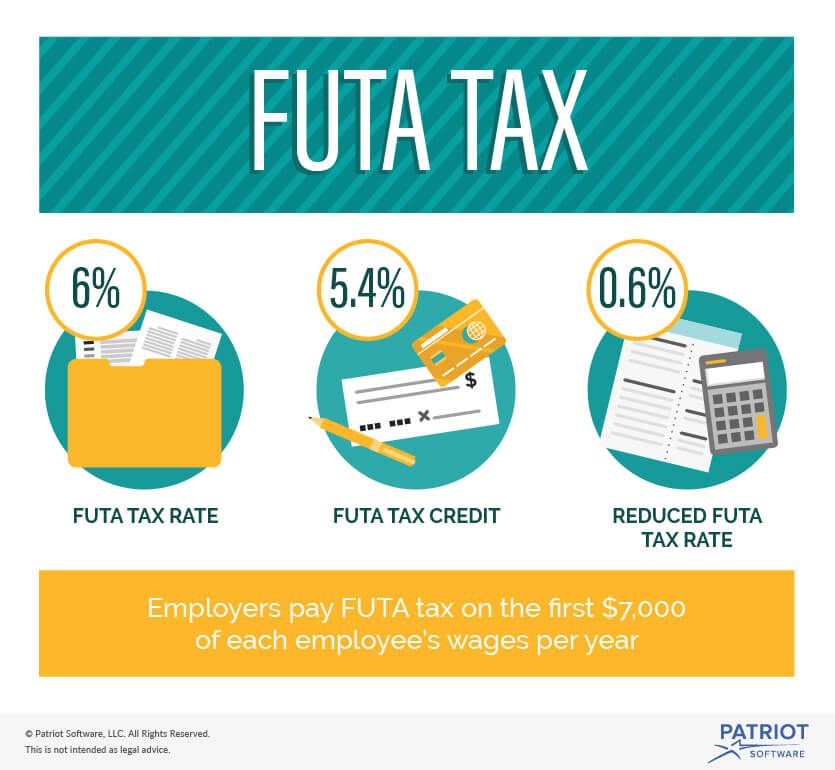

Tax rate for new employers. The SUTA tax program was developed in each state in tandem with the Federal Unemployment Tax Act FUTA which was established in 1939 after the US. The new law reduces the.

The tax rate shown on the Unemployment Tax Rate Assignment Form becomes final unless protested in writing prior to May 1 of the following year. Employers may make a voluntary. Additional Assessment for 2022 from 1400 to 000.

The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. 24 new employer rate Special payroll tax offset. Help users access the login page while offering essential notes during the login process.

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

What Is The Futa Tax 2022 Tax Rates And Info Onpay

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Calculating Employer Payroll Taxes Youtube

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Are Employers Responsible For Paying Unemployment Taxes

How To Reduce Your Clients Suta Tax Rate In 2014

Solved 1 Calculation Of The Suta Tax Payable Name Of Chegg Com

What Is A Wage Base Taxes With Wage Bases More

Futa Tax Overview How It Works How To Calculate

Payroll Tax Rates 2022 Guide Forbes Advisor

Futa Suta Unemployment Tax Rates Procare Support

How To Calculate Unemployment Tax Futa Dummies

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com